ad valorem property tax florida

Taxing Authorities and Non-Ad. It includes land building fixtures and improvements to the land.

Property Appraiser S Office Mails Notice Of Proposed Property Taxes And Assessments To Property Owners In Palm Beach County South Central Florida Life

The community land trust model envisions that the.

. You may also be part of a special district or assessment boundary that has. PDF 125 KB Individual and Family Exemptions Taxpayer Guides. SECTION SIX - AD VALOREMY TAXES IN FLORIDA There are several questions to be addressed in regard to ad valorem taxation in Florida.

Real property is located in described geographic areas designated as parcels. The most common ad valorem taxes are property taxes levied on. In Florida the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments.

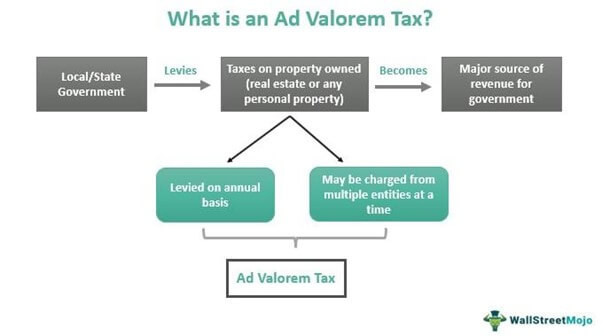

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad valorem means according to value. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property.

Authorized by Florida Statute 1961995. Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. Fair Market Value x 04 x Millage Rate1000 Ad Valorem Tax The first.

Register now to begin the first step of determining your. This application is for use by nonprofit organizations to apply for an ad valorem tax exemption for property used predominantly for an exempt purpose as provided in sections ss 196195. Under the provisions of Section 193621 Florida Statutes FS and Chapter 62-8 Florida Administrative Code some types of air or water pollution control equipment installed at any.

One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. Property tax can be one of the biggest. The Florida Homeowner Assistance Fund may be able to offer you relief for mortgage payments and other homeowner expenses.

Some counties use only or nearly only valorem taxes. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida. The greater the value the higher the assessment.

Ad valorem taxes are calculated using the following formula. These tax statements are mailed out on or. There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant. Real estate property taxes.

Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. The Florida Department of Revenues Property Tax Oversight program provides commonly requested tax forms for downloading.

Ad valorem means based on value. Most forms are provided in PDF and a fillable MSWord. Florida property taxes are.

Non-ad valorem assessments are not based on value but a unit of measure. Tangible personal property taxes. Florida property taxes vary by county.

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

Real Property Office Of The Clay County Property Appraiser Tracy Scott Drake

Cps Florida Property Tax Appeals

Property Taxes Polk County Tax Collector

Florida Voters Approve Housing Amendments 5 6

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

Alert New Law Creates Ad Valorem Property Tax Exemption For Non Profit Alfs Msl Cpas Advisors

Rep Kristin Jacobs On Twitter Order Of Emergency Waiver From The Florida Department Of Revenue Extending Ad Valorem Tax Property Tax Payments From March 31 To April 15 2020 Https T Co F6o6uiw2go Twitter

Ere Inc Specialist In Advalorem Tax Facebook

Form Dr 418e Fillable Enterprise Zone Ad Valorem Property Tax Exemption Child Care Facility Application For Exemption Certification N 12 99

Citrus Property Values And Estimated Ad Valorem Taxes Levied In Florida Download Table

2018 Property Tax Trim Notices For Broward County Mailed Tommy Realtor

Understanding Your Tax Bill Seminole County Tax Collector

What Is Florida County Real Estate Tax Property Tax

Tangible Personal Property State Tangible Personal Property Taxes

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Explaining The Tax Bill For Copb